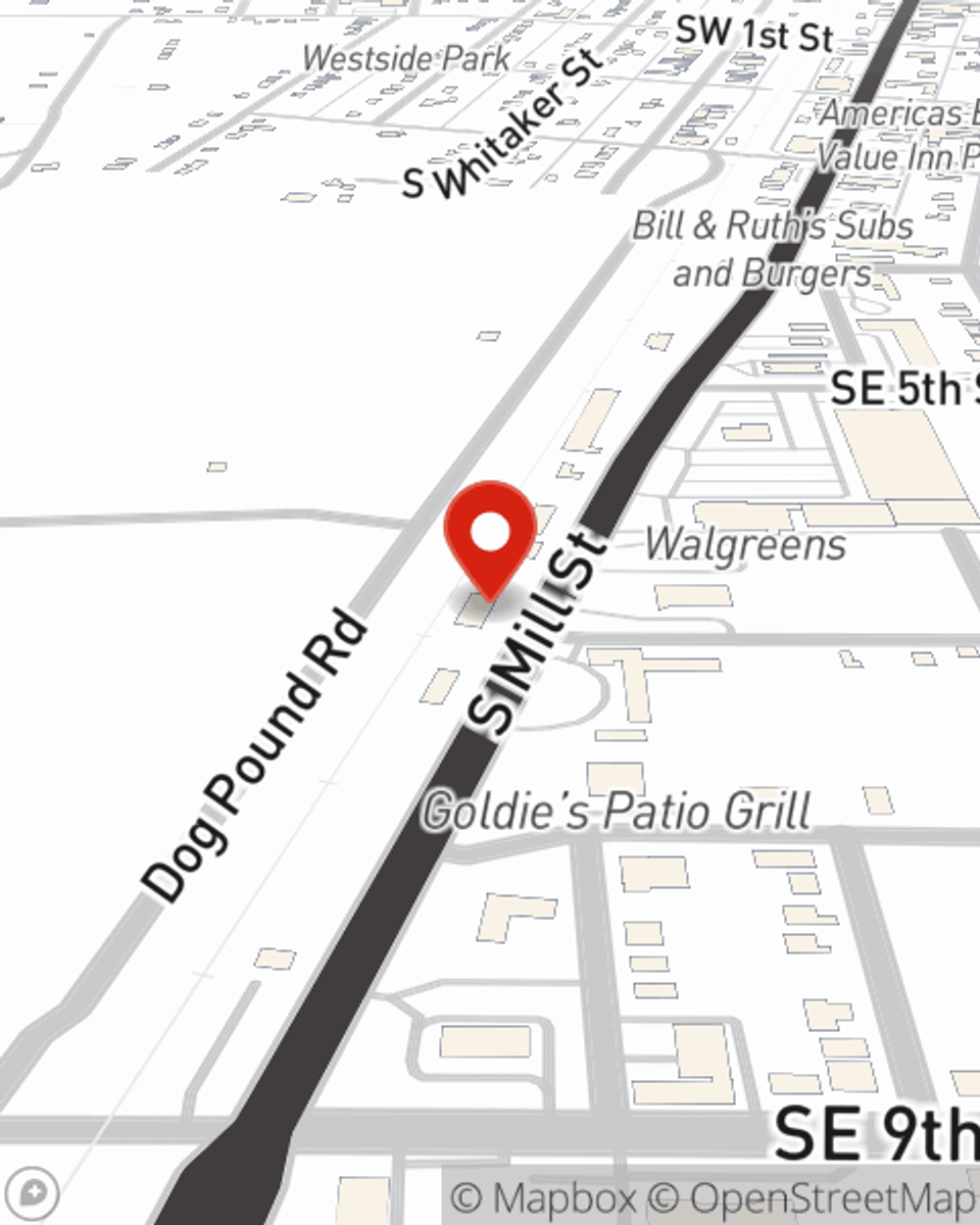

Business Insurance in and around Pryor

Looking for small business insurance coverage?

Cover all the bases for your small business

- Adair

- Locust Grove

- Chouteau

- Salina

- Mayes County

Coverage With State Farm Can Help Your Small Business.

Running a small business is no joke. Insuring your venture should be the least of your worries. State Farm insures small businesses that fall under the umbrella of specialized professions, retailers, contractors and more!

Looking for small business insurance coverage?

Cover all the bases for your small business

Protect Your Future With State Farm

Your business thrives off your passion tenacity, and having dependable coverage with State Farm. While you support your customers and make decisions for the future of your business, let State Farm do their part in supporting you with commercial liability umbrella policies, business owners policies and commercial auto policies.

As a small business owner as well, agent Rhett Minson understands that there is a lot on your plate. Reach out to Rhett Minson today to talk over your options.

Simple Insights®

Disaster preparedness for your business

Disaster preparedness for your business

Create a business disaster plan to protect your employees, secure assets and resume operations.

Cover two people with one policy, often at lower cost

Cover two people with one policy, often at lower cost

Joint universal life insurance can cover two people with an income tax-free death benefit paid to beneficiaries.

Rhett Minson

State Farm® Insurance AgentSimple Insights®

Disaster preparedness for your business

Disaster preparedness for your business

Create a business disaster plan to protect your employees, secure assets and resume operations.

Cover two people with one policy, often at lower cost

Cover two people with one policy, often at lower cost

Joint universal life insurance can cover two people with an income tax-free death benefit paid to beneficiaries.